Made in India: Paving the Way for India to Become a Global Leader in Manufacturing

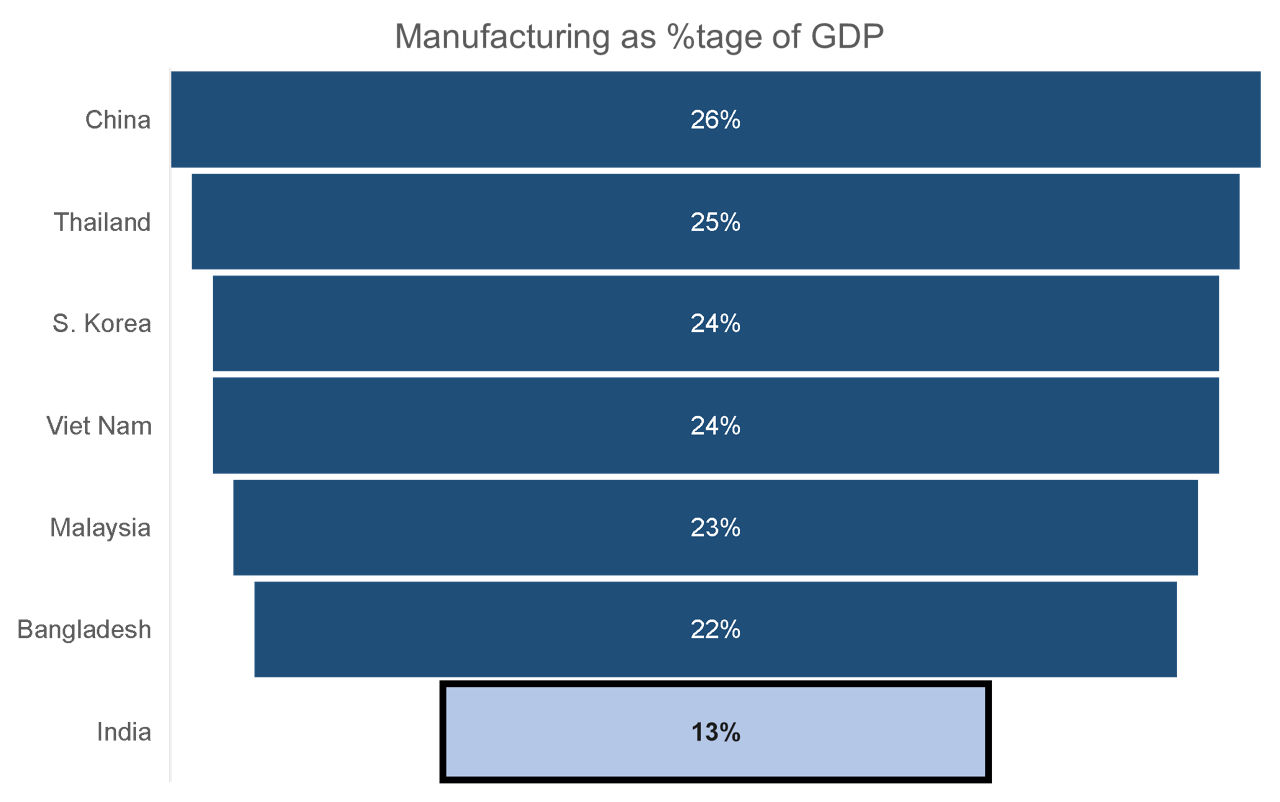

India’s attempts at expanding its manufacturing sector have had middling success historically. The share of manufacturing in India’s GDP has ranged between 13% and 17% through most of the post-independence era. This contrasts significantly with other Asian countries, including immediate neighbours.

Source: World Bank

Despite India being one of the world's fastest-growing major economies for several years, the low proportion is due to multiple factors specific to the manufacturing sector and an extraneous one—the preponderance of services. Compared to the above Asian countries, India developed its services sector much faster and to a greater degree due to its demographics, large educated population base, and widespread adoption of the English language, which helped multiply services exports, especially information technology services.

However, a truly competitive and diversified economy should have a larger share of manufacturing, especially when spending cuts and automation and technology have created an overhang on IT services. Moreover, moving larger numbers of the population away from agriculture and the informal sector and into the mainstream requires a larger and deeper manufacturing base that can create new jobs nationwide for the roughly 8,000,000 Indians entering the workforce each year.

But things are changing. The confluence of multiple strands is providing a belated impetus to various manufacturing sectors as the country marches towards its target of becoming a $5tn economy.

Macroeconomic and geopolitical factors

The COVID-19 pandemic was a major shock to the global supply chain. A specific aspect that exacerbated the effects was the prolonged restriction in China. The stricter and protracted lockdowns affected global manufacturing longer than it should have given that China controls approximately a third of global manufacturing. This led to a realisation that over-reliance on China as a manufacturing base was not good business.

The resultant ‘China+1’ approach is aimed at derisking manufacturing operations by creating production capacities in markets other than China. This strategy reduces the risks of becoming overly dependent on a single country. The hunt for alternatives began in earnest, benefitting several countries. Besides a clutch of neighbouring Southeast Asian countries, Bangladesh and India have been key beneficiaries of this trend. India, in particular, has become a strong ‘China+1’ choice for manufacturing everything from iPhones to speciality chemicals. But why is India the ‘+1’? The country’s multiple inherent advantages drive this choice.

Advantage India

Demand for products

At current prices, private final consumption expenditure in India was worth Rs 1,78,22,526 crore in 2023-24, making up 60.3% of nominal GDP. PFCE growth rates have tracked GDP growth closely for the most part, and several factors show that consumption will grow at a healthy click in the coming years. These include:

Favourable demographics: According to Fitch BMI estimates, approximately 33% of the country’s population is between 20 and 33 years old, which is a key driver of consumption, especially in categories such as leisure and electronics.

Rising disposable income: India’s per capita Gross National Disposable Income (GNDI) grew by 8.5% in the last fiscal year on a large base after expanding by 13.3% in 2022-23. The 23% expansion in two years has been driven by outsized growth in the number of households with disposable income above Rs 30 lacs.

Urbanisation: The proportion of India's urban population was 28.53% in the 2002 census, which expanded to 31.16% in the 2012 census. This stood at 36.36% in 2023 as per the World Bank. Going forward, more than 40% of India's population will live in urban areas by 2030, according to the Economic Survey 2023-24.

Given that India offers an already large and growing consumer base, it makes sense for manufacturers to be closer to this demand pool.

Talent availability

India's potential as a manufacturing hub is underscored by its skilled workforce and participation in manufacturing employment. 13 million people are formally employed in the manufacturing sector. At the same time, estimates suggest that the number in the informal sector is 110 million. The large base also means that labour cost in India is lower when compared to China. Besides this large skilled workforce, India has a growing population of highly trained professionals. The country’s number of researchers in R&D per million population stands at 260, up from just 110 in 2000.

Enabling manufacturing environment

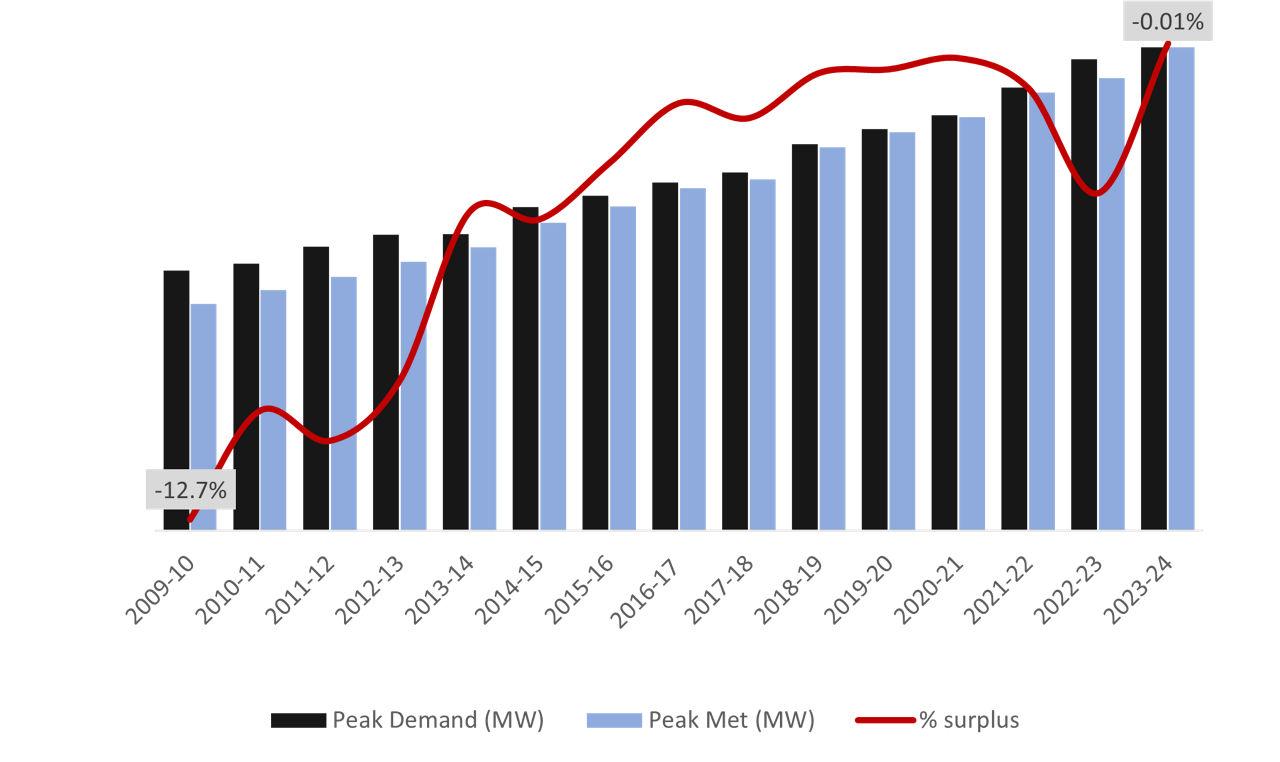

For the first time in the last fiscal year, the peak power demand of 221,370 megawatts was nearly equal to the peak supply. This has happened due to steady improvements in power supply, enhanced generation and transmission capacity, better availability of coal supplies, and additions to renewable energy capacities, providing manufacturing with reliable power supply. In addition to being a key enabler, this growth in power availability is also providing a boost to manufacturing activity in sub-sectors such as transformers, capacitors, switchgear, cables, insulators, energy meters, transmission towers, and conductors.

Government capital expenditure, which has scaled up significantly in recent years, has been critical for developing enabling infrastructure. Budget 2024-25 has provisioned ₹ 11,11,111 crore for capital expenditure, up 11% from 2023-24’s already high base.

Besides the availability of key resources and infrastructure improvements, manufacturing in India has also benefitted from supply chain improvements. For example, the turnaround time at leading ports such as JNPT now averages below one day, which is below advanced country averages. Once deposited, cargo also moves faster out of Indian ports—the average container dwell time in India is now just three days, as per maritimegateway.com. The key metric is four days in the UAE and South Africa, seven days in the US, and 10 in Germany. These and other supply chain improvements have helped India climb 16 positions—from 54 to 38—in the World Bank Logistics Performance Index rankings in the last eight years.

Policy support

Several central government initiatives in the recent past have aimed to grow the share of manufacturing in the economy. Some of these are:

‘Make in India’ initiative 2014

Under the Make in India initiative, launched in September 2014, the Indian government offers economic incentives to attract greenfield and brownfield investments in domestic manufacturing. Under Make in India, 100% FDI for brownfield and greenfield setups is permitted. In addition, tie-ups at the country level were encouraged to boost tech transfer. To promote investment, Make in India fosters innovation, enhances skill development, protects intellectual property, and develops critical infrastructure.

PLI scheme for manufacturing

The production-linked incentive, or PLI, scheme for manufacturing is another government scheme applicable to large-scale manufacturing. From March 2020 onwards, multiple sectors have been covered under the PLI scheme, including auto and auto components, aviation, chemicals, electronic systems, food processing, medical devices, metals & mining, pharmaceuticals, renewable energy, telecom, textiles & apparel, and white goods.

What next

India’s ambitions are driven by import substitution but extend into controlling more of the value chain in critical frontier sectors and emergent areas. These include batteries, solar energy, high-end consumer electronics, and semiconductors, which a select few countries have hitherto controlled. The ambition is to repeat the success India has already seen in becoming a substantial exporter in segments like automobiles, automobile parts, pharmaceuticals, petroleum products, speciality chemicals, and textiles.

There are many critical success factors needed to see through this intent, and any challenges on these counts can still derail the ambition. The most vital is technology. “Manufacturers will need to be on the top of their game and use of contemporary technologies in improving their processes, systems, productivity, and thereby their competitiveness,” says Chandan Chowdhury, Professor of Operations Management and Information Systems (Practice), Indian School of Business. According to him, the contemporary technologies driving synergies in Industry 4.0 include robotics, cloud computing, 3D printing, data analytics, blockchain, the Internet of Things, artificial intelligence, and machine learning.

In addition to being on top of the technology game, this ambition for manufacturing will require political stability, policy continuity, stable government finances that continue incentives, improving labour productivity, and broadening education, especially higher education.