How a Mandate Shrunk India Inc’s Voluntary Philanthropy

Neuroscientists prescribe the fact, that any mandate feels like a violation of autonomy - which is one of the most intrinsic drivers of threat and reward for the human brain. When India mandated CSR spending for firms, an impact was seen on voluntary philanthrophy.

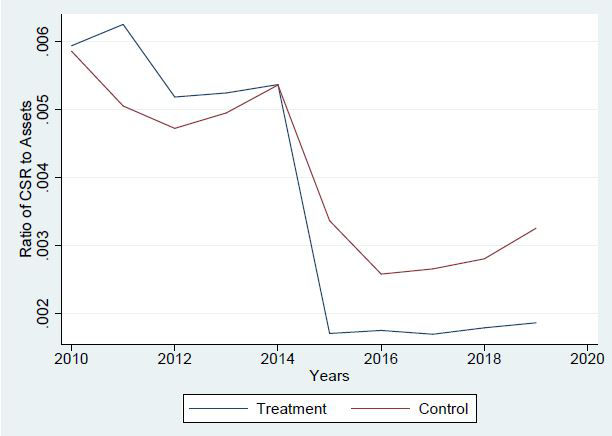

GoI’s two per cent mandate of 2014 egged corporates to reduce CSR spending over a five-year horizon, before and after enforcing the law

Research Paper: Does a Government Mandate Crowd Out Voluntary Corporate Social Responsibility? Evidence from India; Journal of Accounting Research, Sep 2022

In an environment of large-scale protests over environmental responsibility and social development, in April 2014, India became the first nation globally to adopt a CSR mandate. The regime in Delhi changed a month later, but the mandate stayed. Today, studying a five-year horizon before and after coming into force, the law seems to have hurt rather than cemented India’s corporate philanthropy and the firm value it brings.

The two per cent of the average three years profit that firms are mandated to spend on Corporate Social Responsibility brought many into the corporate philanthropy fold. In this study, the researchers focus on firms that voluntarily spent more than two per cent before the mandate was enforced. The researchers draw on firms’ CSR data from the Prowess Database of the Centre for Monitoring the Indian Economy (CMIE) and the Ministry of Corporate Affairs data on mandated CSR spending.

As expected, with several new firms forced to spend on CSR, overall spending on CSR increased by 82 per cent in the post-mandate period. But what motivated High CSR spenders on their philanthropy pre-mandate, and why not so now? More importantly, does advertising uniquely signal virtue and product quality, as voluntary CSR does?

Good beckons goodwill

'Goodness is the only investment that never fails,’ believed Henry D Thoreau, American writer, philosopher and political influencer to Leo Tolstoy, Mahatma Gandhi, and Martin Luther Jr. This philosophy seems to be driving the High CSR spender firms in India well before the mandate was enforced on them to guarantee goodness.

Their study results establish that CSR has a strategic value that gets diluted when the government mandates CSR spending. So, why did firms engage in large-scale voluntary philanthropy before the mandate?

Earlier literature on voluntary audits and International Financial Reporting Standards tells us that any action will likely have positive signalling value when undertaken voluntarily. Information conveyed to capital providers by voluntary action reduces financial frictions, improves loan terms with banks, increases liquidity and provides several other benefits.

Similarly, the researchers find that the signalling value of voluntary CSR spending is for a firm’s product quality and virtue. But a mandate to spend on CSR reduces the firm’s ability to differentiate itself through voluntary CSR spending in the eyes of investors or customers. While High CSR firms could have increased spending post-mandate to maintain their differentiation, the researchers do not observe such an increase in their data.

High-CSR firms may have considered it wasteful to spend more on CSR owing to their non-availability of meaningful CSR projects justifying any additional expenditure. Secondly, higher compliance costs in the post-mandate period and reduced flexibility in project approvals from the Board may have affected their decision to spend higher than the mandate.

Finally, even with meaningful CSR projects available, the difficulty in dividing them into ‘2 per cent’ and ‘above two per cent components further increases compliance cost in proportion to the overall CSR spending. So, the net benefit derived from voluntary High-CSR spending may not be worth the total expenditure for High-CSR firms.

The researchers explore whether High-CSR firms opt for a substitute for CSR spending. The High-CSR firms, who reduced their CSR spending significantly, looked for an alternative to the value addition arising from voluntary CSR. One of their findings showed that such firms increased their advertising expenditure post the mandate. The increase in advertising expenditure equals these firms’ expense cutback on CSR.

The researchers also found that these firms reduced CSR communications significantly. They also decreased the number of words in these communications that conveyed product or service quality or signalled virtue. The spending on advertising for these firms went up by the same level they cut their CSR expenditure.

"The researchers find firms’ advertising spending to increase significantly, by 24.85 per cent, post-mandate compared to the pre-mandate expense level for advertising"

In their study, the High-CSR firms witness an increase in operating expenditure and not revenue, suggesting that they incur additional expenses beyond a one-to-one replacement of CSR with advertisement to maintain the same income level. The researchers find firms’ advertising spending to increase significantly, by 24.85 per cent, post-mandate compared to the pre-mandate expense level for advertising.

This means voluntary CSR is more effective vis-à-vis advertising in creating value by signalling high product quality and virtue.

Mandate impact

The researchers look at pre and post-mandate CSR spending for one part of their study. The researchers classified firms under various categories of voluntary CSR, ranging from those spending none to those paying higher than 10 per cent of their net profit before the mandate was enforced.

Post the mandate; the researchers expected Low-CSR firms (spending less than 2 per cent of profits before the mandate) to spend close to 2 per cent after the order. The data proved this expectation. Low-CSR firms increased their CSR spending from 0.7 per cent of profits before the mandate to 2.2 per cent after it.

However, for High-CSR firms (those spending more than 2 per cent of profits before the mandate), the researchers see a significant cut in their CSR spending -- from 10.8 per cent of profits before the mandate to about 3.6 per cent post-mandate.

Next, the researchers segregate High-CSR firms as those qualifying under the mandate to spend on CSR and those that are not. They identify a sharp decline in the difference between these two types in the post-mandate period compared to the pre-mandate era. This decline was measured at INR 7.87 million, or 29.78 per cent of the average CSR spend in the pre-mandate period, which is an economically meaningful fall.

"Their test results suggest that the voluntary High-CSR spenders cut expenses significantly in response to the CSR mandate post-2014."

Their test results suggest that the voluntary High-CSR spenders cut expenses significantly in response to the CSR mandate post-2014. The ratio between CSR spending and the firm’s total assets also reflected an economically meaningful decline of 14 basis points or 32.57 per cent of the pre-mandate levels.

Value of good

To compare the stock market reaction of the high-CSR firms, the researchers look at a sudden announcement of July 17, 2019, by the finance minister, which stated that henceforth non-compliance with the CSR provisions would constitute a criminal offence and not be considered a civil offence. The finance minister reversed this position on August 23.

The event allowed the researchers to study the shareholder value implications of voluntary CSR. On July 17, 2019, stock prices of CSR-mandated firms reacted negatively to the event (-1.2 per cent), and those of High-CSR firms declined by 0.8 per cent. With the reversal of the position of the finance minister on August 23, investors appeared to reverse the decline witnessed by mandated high-CSR firm stocks.

"In the five-year horizon before and after the CSR mandate was introduced, the researchers see that firm’s Return on Equity (RoE) declined by an economically meaningful 11.51 per cent"

In the five-year horizon before and after the CSR mandate was introduced, the researchers see that firm’s Return on Equity (RoE) declined by an economically meaningful 11.51 per cent. The decline in Return on Assets (RoA) was a significant 8.08 per cent of the average RoA during the pre-mandate period.

Their key findings show that the imposition of mandatory CSR crowds out voluntary spending on CSR. Also, the researchers find voluntary High-CSR firms suffer valuation discounts and a decline in operational performance post-mandate. These results suggest that voluntary CSR was valuable to firms before the mandate, and it got diluted after the decree was enforced.

What this decline in voluntary spending by High-CSR firms means for the CSR strategy of all firms, in general, remains a question to be answered by future research.

The graph depicts pre- and post-mandate CSR spending trends between the ‘treatment group’ (firms required by law to spend on CSR) and the ‘control group’ (firms not required by law to spend on CSR). We see both types of firms were spending more than 2% of their average three-year profit in the pre-mandate period and reduced spending drastically in the post-mandate period (after 2014)