Technology Digital Transformation

Value Creation in the Digital Age – From Pipes to Platforms

Platform business models signal a strategic shift, empowering tech startups and digital giants to outmaneuver traditional rivals. This transformation pivots resource control to resource orchestration, reshaping industries across the spectrum.

In recent years, many technology startups and digital giants have leveraged the “platform business model” to gain a competitive advantage over traditional incumbents in diverse industries. Google, Apple, Amazon, Alibaba, Uber, and Airbnb are all examples of companies that have leveraged the key principles of platform business models to fundamentally disrupt how value is created and extracted in diverse product markets and industries. Not surprisingly, these digital juggernauts have catapulted to trillion-dollar market valuations, making them some of the most highly valued companies in the world.

Platforms strive to create competitive value by deviating from the classic linear value-chain model or conventional “pipeline” businesses. These business models predate the digital economy, be it malls and credit cards that link consumers and merchants or auction exchanges that bring together buyers and sellers of goods. However, forces of digitisation, including the separation of information goods from physical artifacts and low marginal costs of creating and sharing information goods, have led to the significant growth of digital platforms that allow frictionless participation among different stakeholders.

While competing in the digital economy, traditional businesses must consider harnessing the power of technology to orchestrate or at least, participate in platform economies.

The Key Components in a Platform Ecosystem

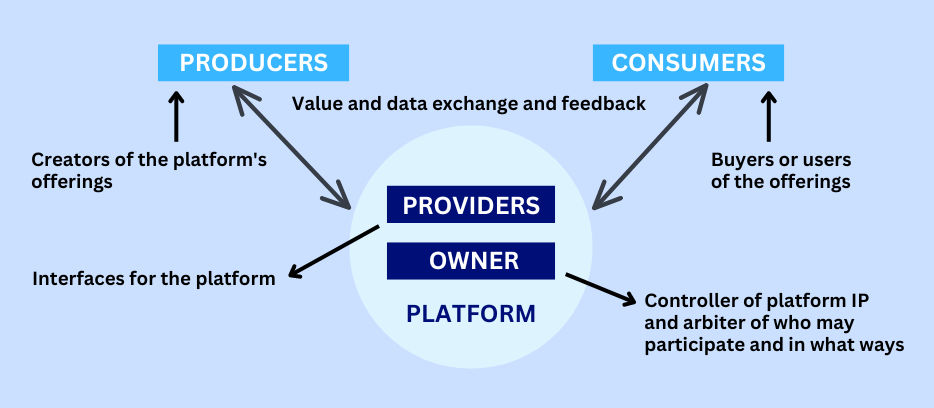

A platform ecosystem consists of platform owners and providers who bring together producers and consumers of product and service offerings in high-value exchanges. Owners (for example, Visa or Mastercard) control the platform’s intellectual property and govern the rules and architecture of what stakeholders are allowed to do on the platform. Providers (for example, banks that provide the credit card) serve as the platform’s interface with producers and consumers. In many cases, these roles may converge (e.g., Google, Facebook, Amazon).

Central to platforms is the concept of network effects of demand-side economies of scale. The value of a platform to participants on each side increases with the number of users who affiliate on the other side. Network effects are at the heart of pricing and other competitive strategies in platforms. They create barriers to exit for platform users and in turn, barriers to entry for competitors, help build better products and tip winner-take-all markets.

Whether it is Uber in transportation, YouTube in media, or Airbnb in hospitality, we are witnessing the exponential growth of platform business models along key performance metrics like the number of users, volume of content, number of rooms, number of payments. Another example is Apple’s domination in its industry in which Nokia and other companies had classic strategic advantages. Apple conceived the iPhone and its operating system as more than a product that was the output of a linear manufacturing pipeline. It imagined it as a means of connecting participants in two-sided markets—app developers on one side and app users on the other— generating value for both groups

While many technology startups and digital giants may be born platform models, it is also feasible for industrial economy incumbents to invest in platform businesses. Below, we provide insights into how you can think about “platformisation” of your business, and here are the key shifts in resources and capabilities that you need to invest in to make the transition from pipeline to platform:

What is Your Information Good?

Technologies like Internet of Things (IoT) make it possible for industrial economy incumbents to separate information from physical products. For example, General Electric, in generating digital twins of its industrial equipment through IoT, allowed information on the equipment to be separated from the equipment, analysed, and remotely controlled to drive timely decisions, including real-time and predictive maintenance. In such case, the operating and other information on the machine would serve as the basis for a platform that would connect developers of industrial equipment applications (such as asset optimisation) with manufacturers of equipment. The first step, therefore, is to identify the information goods that would serve as the basis for platformisation efforts in the company.

What is Your Ecosystem?

Platform business models represent a fundamental shift in strategic focus from resource control to resource orchestration. They seek to maximise the total value of an expanding ecosystem in a circular, iterative, feedback-driven process. That is, the greater the resources that the platform can marshal, the greater the network effects and the greater the value it can create and extract. In the case of General Electric, the IoT-enabled equipment would sit at the centre of an ecosystem that included equipment buyers, their supply partners, and service providers. The resultant data, algorithms, and applications from this ecosystem would serve as the base for connecting developers and manufacturers and network effects. It becomes important, therefore, to identify the ecosystem that you need to orchestrate to create value and eliminate barriers to production and consumption for key ecosystem participants.